Yearly salary paycheck calculator

To determine your net income you have to deduct these items from your gross annual salary. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12.

So Would I Be Accurate In Saying How Much You Make Is Less Important Than How You Handle What You Make Chec Money Habits Better Money Habits Financial Tips

Next select the Filing Status drop down menu and choose which option applies to you.

. These figures are exclusive of income tax. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. 30 8 260 - 25 56400.

This salary calculator estimates total gross income which is income before any deductions such as taxes workers compensation or other government and employer deductions. To determine her annual income. Mortgage Calculator Rent vs Buy.

75000 12 pay periods 6250 per pay period. Enter your info to see your take home pay. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

The adjusted annual salary can be calculated as. Dont want to calculate this by hand. ADP Salary Payroll Calculator.

All bi-weekly semi-monthly monthly and quarterly figures are derived from these annual calculations. On a 20-year HELOC which has a current average rate of 734 the. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12.

Add your state federal state and voluntary deductions to determine your net pay. Say your employee earns a weekly salary of 1000 and has 200 worth of deductions and taxes every week. This calculator is intended for use by US.

If that salary is paid monthly on the 1st of each month you can calculate the monthly salary by dividing the total salary by the number of payments made in a year to determine the rate of pay on each paycheck. The PaycheckCity salary calculator will do the calculating for you. Hourly rates weekly pay and bonuses are also catered for.

Using the United States Tax Calculator Using the United States Tax Calculator is fairly simple. Enter your info to see your take home pay. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford.

The gross pay would be 1000 while the net pay would. To calculate your yearly salary it would simply be. It can also be used to help fill steps 3 and 4 of a W-4 form.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Here are some calculators that will help you analyze your paycheck and determine your take-home salary. SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes.

Yearly salary paycheck calculator Kamis 08 September 2022 Edit. Why not find your dream salary too. If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary.

Weekly Salary Daily Salary Days per workweek. Enter your info to see your take home pay. The following table highlights the equivalent weekly salary for 48-week 50-week 52-week work years.

Generate your paystubs online in a few steps and have them emailed to you right away. To calculate your yearly salary from monthly simply multiply your monthly payment by 12. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Ad In a few easy steps you can create your own paystubs and have them sent to your email. New York Salary Paycheck Calculator. Semi-Monthly Salary Annual Salary 24.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. Annual Salary Hourly Wage Hours per workweek 52 weeks. 11 hours agoThe current average 10-year HELOC rate is 617 but within the last 52 weeks its gone as low as 255 and as high as 620.

Susanne earns 15 per hour and works full time 40 hours per. Note that deductions can vary widely by country state and employer. Select your location and add a salary amount to find out how much federal and state taxes.

Daily Salary Hourly Wage Hours per. Biweekly Salary Annual Salary 26. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

If youre still curious about how our yearly salary calculator works here are two examples showing it in practice. This number is the gross pay per pay period. Social Security and Medicare.

Quarterly Salary Annual Salary 4. Gross pay is the amount of pay an employee earns before any taxes and deductions are taken out while net pay is the amount an employee receives after taxes and deductions are taken out. For example imagine you earn 5000 per month.

First enter your Gross Salary amount where shown. The latest budget information from April 2022 is used to show you exactly what you need to know. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes.

Monthly Salary Annual Salary 12. SmartAssets Florida paycheck calculator shows your hourly and salary income after federal state and local taxes. The formula of calculating annual salary and hourly wage is as follow.

If your effective income tax rate was 25 then you would subtract 25 from each of these figures. If you are filing taxes and are married you have the option to file your taxes along with your partner. Neuvoo Salary and Tax Calculator.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Biweekly pay 48 weeks.

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template

Hourly Wage To Annual Salary Conversion Calculator How Much Do I Make Per Year Marketing Jobs Salary Conversion Calculator

Salary To Hourly Calculator

Building Maintenance Checklist Templates 7 Free Docs Xlsx Pdf Maintenance Checklist Checklist Template Checklist

Download Employee Provident Fund Calculator Excel Template Exceldatapro Excel Templates Payroll Template Budgeting Worksheets

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Pay Scale What Is Pay Scale How To Calculate Pay Scale Paying Scale Consumer Price Index

Annual Salary To Daily Pay Conversion Calculator Daily Activities Happy Life Routines

The Truth About Wedding Photographer Salary And Pay Wedding Photographers Wedding Photography Tips Photographer

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Calculator Templates

Pin By Jessica Shearer Heihn On I Like That Stay At Home Mom Stay At Home Mommy Life

Monthly Take Home Pay From A 100k Annual Salary Vivid Maps Map Personal Financial Planning Salary

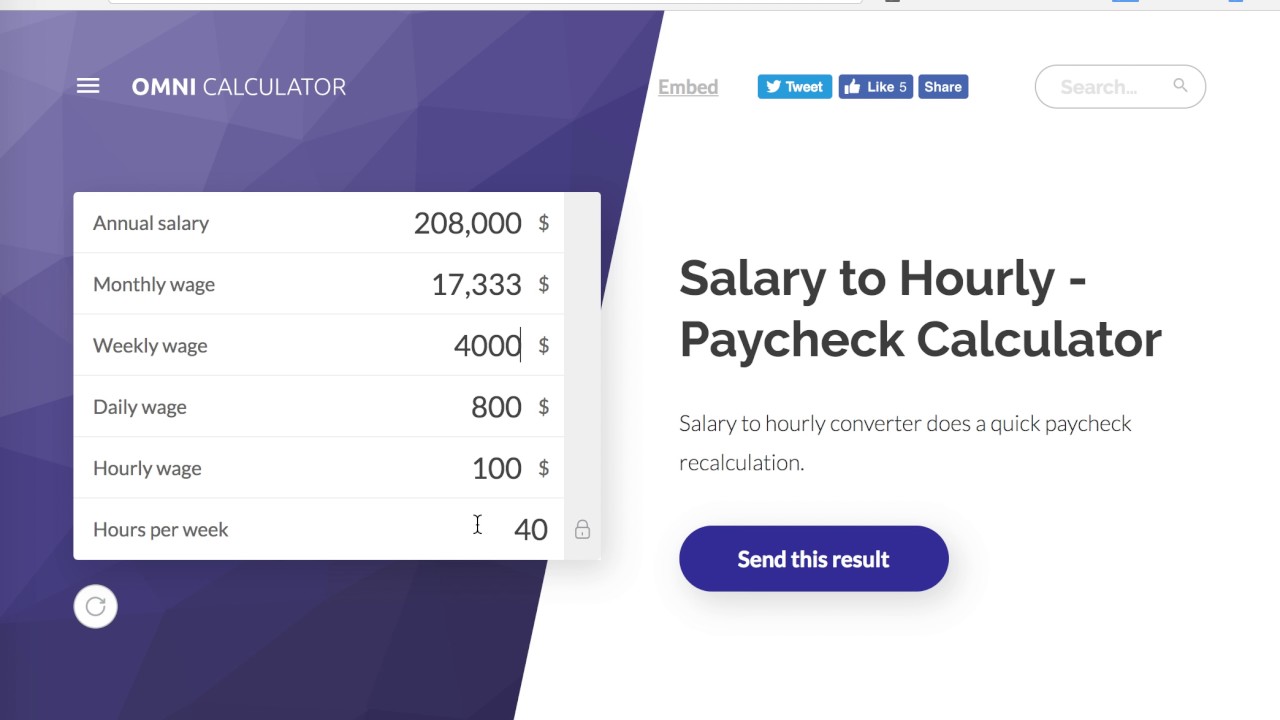

Salary To Hourly Salary Converter Omni Salary Paycheck Finance

Pin On Raj Excel

Calculate How Long It Takes Tech Ceos To Earn Your Salary Pay Off Your Debts Simpletexting Com Salary Earnings Debt

How To Calculate Your Net Salary Using Excel Salary Excel Ads

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Calculator Salary